"Develop a money management plan. Your first goal must be long-term survival; your second goal, steady growth of capital; and your third goal, making high profits. Most traders put the third goal first and are unaware that goal 1 and 2 exist."

Hey there! I hope you are having a wonderful start to the New Decade! This past week has been an absolute blast, to say the least. The overall Markets have been heating up as this is the first month of January. There is something called the January effect. If you don't know what the January effect is, I highly encourage you to watch this video from Tim Sykes

here. Is this your first blog post? I thank you for taking the time to stick around. I want to emphasize once again that I am not a Guru, nor am I a master of the Markets. Being transparent is my main mission within this Blog. To this point in my trading process I have no state of profitability, nor do I have a trading system. This blog is intended to write about my trading process towards the state of profitability. So where am I in Week 76? I have everything I want, but a trading account. Yes! I have not even opened up a brokerage account. That is the sole purpose of me taking a year away from College. Most of my Peers call me crazy, they tell me you're taking a risk. The most common response is "Why don't you just finish College". My answer is always the same. Going to College is not in alignment with what I am trying to accomplish. Once more I am not saying that getting a college degree is worthless, but never confuse Education with School. I do plan on going back, but I need to allocate time towards my desire. The only thing that is against you is TIME. Understand that everyone has 24 hours in a day. The big question is how are you going to allocate your time to better prepare yourself. School is always going to be there, but I can't get back my TIME. Most importantly I have nothing to lose. I am 20 years of age, I am grateful that I started at a young age. I want you to take the time to watch the video below. It will be worth it.

I don't know if anyone will ever read this. but just understand that don't let FEAR hold you back from your desires. To change your life, your going to have to sacrifice everything. Take RISK young. The experience will be worth it. The only thing you have is time! Spend it wisely. Again I never in a million years would have thought I would have been attracted to the Stock Market. I never decided to become a Trader, I simply never stopped Learning! Again what's the risk? I have nothing to lose, I have everything to gain! Well, let's dive right in, and talk about this past week! There is a lot to discuss!

Firstly I will start with $SAVA, what a runner this has been. This has been an absolute gift from the market, to say the least. I fully underestimated this one. As I had $SAVA on the scan from last week, this was a great long towards the upside. There is no significant news to warrant the uptrend, but again Price action is king. The fact that this was consolidating heading into Friday was a bullish sign, to say the least, again must think about the Crowd Mentality. Understand that what moves the Markets is beliefs, never fight the crowd. $SAVA was a prime example of that. I mean yes, I don't want to be a hindsight trader, because hindsight is always 20/20. There was no clear trend change, the fact that this gaped up on Wednesday and Thursday gaped down trapped shorts. When $SAVA gaped up on Friday, that was a clear sign that the trend has not reversed. Shorts got too aggressive too soon. It's not coincident that at 12, you see a nice ramp. That is due to a simple short Squeeze, along with momentum buyers. Again I can't predict a short squeeze. In my guess, there were likely shorts who were victims of Buy-ins. Mealing that they had to cover their share, the broker wants their shares back. That is just a there. I don't have a disco ball next to me. $SAVA is going to be a top watch going forward. There are going to be tons of opportunities to come next week. Take note that a Short Squeeze is not lasting, never say that it can't go higher. I don't have to catch the exact top. Fuck the EGO! I will have a sniper mentality. Wait for the trend change. Ideally, I will be aiming for a potential fade if the whole $9 marks fail. $SAVA is mid-range as of right now, the $10 range is going to be massive overhead resistance. The higher the better, but will wait for the trend change!

$FCEL was another runner that was on the scan from last week. Once more I fully underestimated the power of Recent Supernova's. If a stock has run in the past, it can run the future. $FCEL has ran in the past but failed to hold it's gains, as the $1 mark rejected. This time around $FCEL trapped Shorts and led to the massive upside. $FCEL had a nice morning panic as the topping action was the sign that the momentum was fading. Overall this is going to be ticker to watch. I will avoid any mid-range action. Ideally, there will be a bounce on $FCEL. Don't take your eye off this one.

|

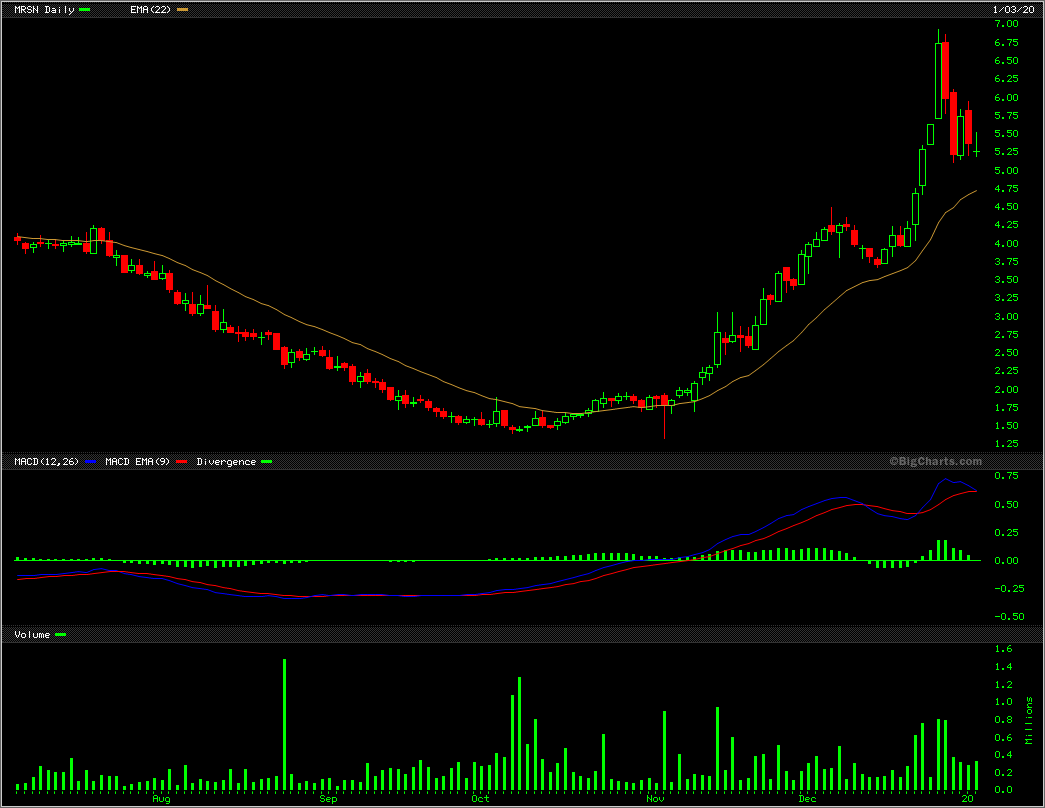

| $MRSN 6 Month | | |

|

$MRSN was a beauty from scan last week. Nice first red day pattern. When I see a stock that has ran up without any significant pullback I do expect one. $MRSN was a nice gift. Ideally, we get a bounce, if not this is going to be a fade if the whole $5 mark cracks. I will avoid any choppy mid-range action. If the liquidity fades, I will not be in illiquid stock.

|

| $CLSD 6 Month |

$CLSD was as well a nice beauty from scan last week. Another nice overextending, and wait for the clear trend change. The first red day strikes again, I did cover my short into the bounce after the first red day. In hindsight, I should have held, because $CLSD faded too a fucking tee. Onto the Next!

|

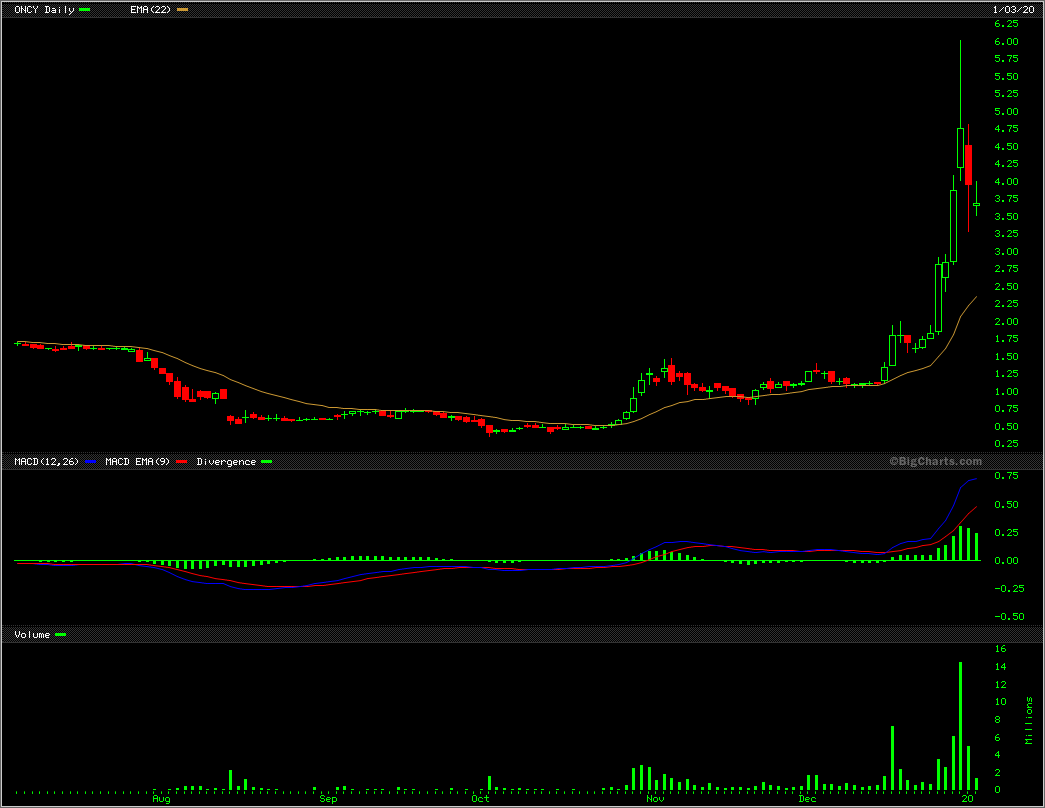

| $ONCY 6 Month |

|

| $ONCY 10 Day |

$ONCY was another one that I underestimated. This was a nice overextension, that was a great long and shorting opportunity. Again take note of the classic topping action, when the sideways price action takes effect. $ONCY was a absolute beauty both on the Long and Short side. The liquidity is fading, but I will keep it on watch for any potential bounce.

|

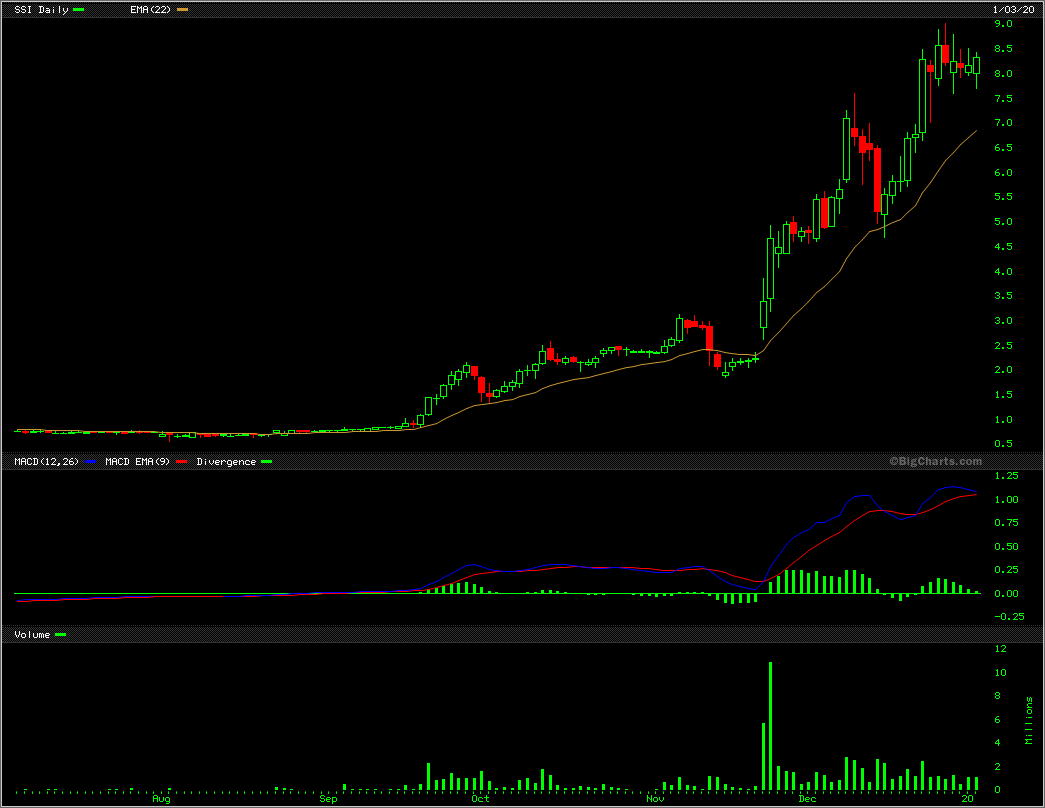

| $SSI 6 Month |

$SSI has been a nice overextending chart pattern. Ideally, I was aiming for a potential fade this past week. This has been consolidating in a tight range for the past week. The volume is fading, but this is a very illiquid stock. It's so choppy, but I will keep it on the scan. $8.00 is going to be a potential fade, but again must be patient with this one.

|

| $OWCP 6 Month |

|

|

| $OWCP 10 Day |

$OWCP has been the hottest stock in the entire Market. It makes me laugh when people down this niche. $OWCP from top to bottom is a nearly 1250% Gain. Never underestimate the power of an OTC. I hear people arguing about the fundamentals. Dumb Fucks, these stocks don't move off fundamentals. They move based on Price Action. Buy the breakout is what was rigging in my head. In my opinion, shorting when the price range is so low, is terrible risk rewards. Again I am not a financial advisor, but in my opinion I need more meat on the bone. There was a nice morning panic on $OWCP, which was fully predictable. It was not a question of IF, but WHEN. I did not trade it, but I witnessed it. Overall this is holding its gains well, the volume is fading which is a great sign. I will keep a close eye on it. I will avoid any mid-range price action or non volatile price action.

|

| $NVCN 1 year |

|

| $NVCN 5 Day |

$NVCN was a nice Gap short that the Market handed. As Nate from Investors Underground would day "looking left to see the right." The chart tells the story. The inability to hold its gains, the toxic dilution that $NVCN has done in the past. Human nature never changes. This time around nothing changed. The same fucking outcome. $NVCN did raised which is not surprising, they are desperate for cash. The skeletons are hidden in the Filings. Go and Read! Onto the next!

|

| $CEI 6 Month |

|

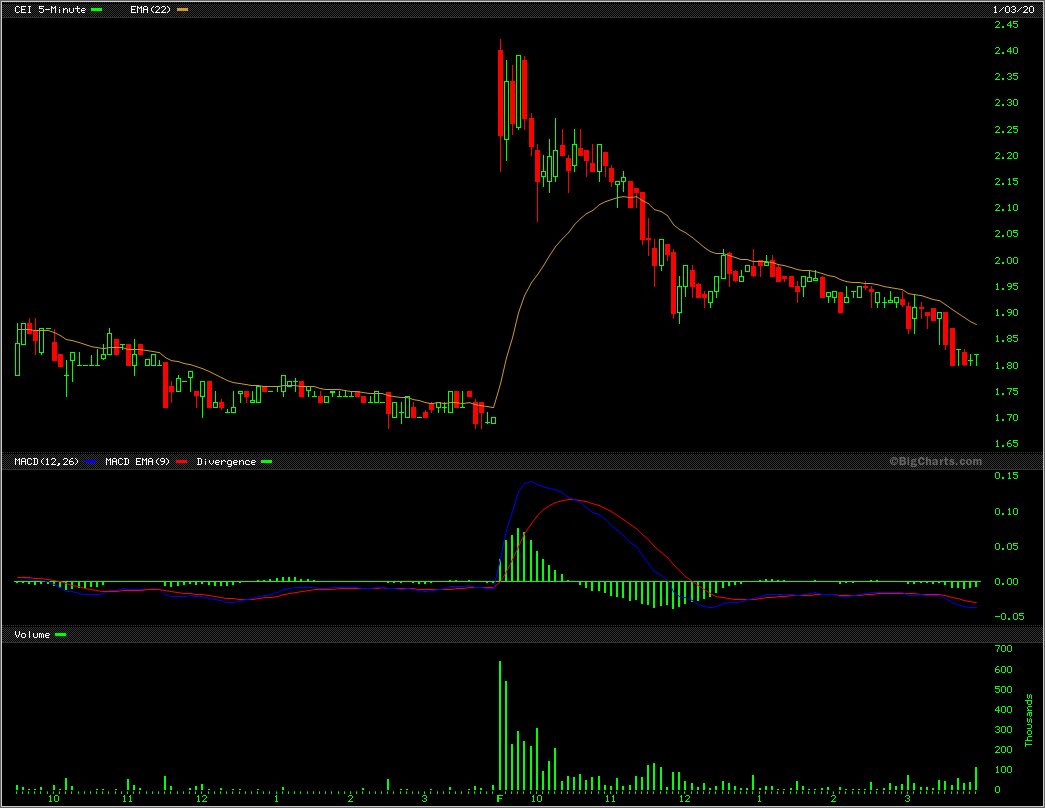

| $CEI 2 day |

$CEI was another classic Gap short. Once more human nature never changes. Look left to see the right. $CEI has been notorious for Toxic Dilution, as the chart reflects that. Overall this was not a drastic drop, but the pattern is there. I will keep a close eye on this one as this has a history of spikes. I know what $CEI has in store, Dilution machine.

|

| $YUMA 6 month |

|

| $YUMA 2 Day |

$YUMA was the top runner this past Friday. Overall I was anticipating this to run,but instead, this faded the entire day. This has ran in past, but again does not have a solid track record of holding those gains. Ideally this fades more, potential bounce short if this does have a nice solid bounce.

So I'm 76 weeks in! Where am I in my Trading Process? Let's dive right in!

- I still can't believe that is has been 76 weeks since I found my obsession. I don't see my doing anything else, but Trading. I can't stay away from the Markets. Note* I am not an Addictive gambler, I am Professional Gambler. I don't look for a trade, I simply wait for the trades to come to me. The goal is to trade well not Often! My only goal is to outlast my enemy. Stay in the game! That is why I began this post with a section from a book that I am currently reading. 90% come into this game for the high profits, they want the outcome but are they willing to sacrifice en route. The 10% focus on the Process! Focus on the process and the outcome will come naturally! When I open a brokerage account very soon, my only goal is Survival. Understand as a Trader, the game is set up against you already. With Slippage and Execution fees. Soon I will open an account. I was aiming for mid Summer, but the Target is April. I will be starting small. That is the key, there is nothing wrong with stating small. Grow organically! Let's put it into perspective if funded an account with $3000 compared to an account with $25,000. There is going to be a huge psychological difference. Note* everyone has unique risk thresholds, but I highly advise only put in what your willing too loose. I would much rather lose the $3000 than the $25,000. The 3k would is not emotionally devastating compared to the 25k loss. Understand the loosing is vital in this game. I know that when I open a live account, losing is inevitable. I accept it. The key is to minimize your losses while maximizing your gains! That is why I fucking hate when I see Trades talk about how many Green Days they've been on. In the end, your fucking streak does NOT MATTER! Stay in the game, next steady growth of capital. How? Trading a system that works for you. Note* what works me, may not work for you. That is why I encourage you, in the beginning, to be like a sponge, take it all the information. As you progress as a Trader, filter out the noise, and focus on one or two set-ups and exploit them. OK. So here is the game plan. Currently, I am still developing my Methodology. How? By Trading in simulator account, reading, and learning from other Traders, Mostly tracking statistics and reviewing Charts. I Love the Charts. Next, the game plan is to open an account via E-Trade or Trade Zero. How? By trading time for money. As you many now, I currently work at Black's Barbecue. I will be saving in order to open an account. After the account is open, it's game time. I have no expectations, just to Survive. I made it this far, and I am still here. I will see you next week!

Update: 2020 is going to be the best year yet. I got what I want. A year off from school. I am now living my dream! When I look back, I will be grateful that I kept ongoing.

Disclaimer: This blog has a term of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

Comments

Post a Comment