Week 55 and Beyond

Hey there! Once again it has been an absolute fantastic week to say the least. One more week closer to the goal. School is looming around the corner. As normal I will talk out stocks,but first I want to give you an update on where I'm at in my trading Journey. As you know I have been immersed in the Markets for little over a year. I have given nearly every single day towards the markets to better increase my odds of success in the long run. Again I never decided to become a Trader, I just simply never stopped learning. Once I was exposed to this game, I was immediately hooked. For the past 55 weeks have been growing my knowledge account. Understand that the reason the vast majority of people who get into trading are for the Money aspects. That's Fine. I understand that the purpose of trading stocks is to "make" money. Although you don't make money in the Markets, it's transferred from the uneducated to the Educated. The only reason the money is there in the first place, is because other traders put it there. The Money in my opinion is the bi-product of my craft. There is a saying that it takes10,000 hours to master a skill. In my opinion I do agree, but understand that Trading is NOT an exact science. It's not a direct cause and effect, just because you study does not mean you will become the next Millionaire. It just better increases your odds of success in the long run. So where am I at?

In two weeks I will be returning to school at Texas State University. For those who don't know I am currently a Sophomore. As you may know, most schools offer Financial Aid for assistance to those who need it. For the cost of living, books, food, etc. I remember last January January I was planning to open a Monetary Account, but things did not turn out as expected. I always say that everything happens for a reason. Perhaps that was for the best because I can honestly say looking back. I was not prepared. So what? Ideally, the return I will be receiving will be $3500. To be bold, you have to do bold things. I was aiming to purchase a year membership to Stocks to Trade, but a voice inside of me said otherwise. Understand that I love Stock to Trade, its the real deal. Of course, it will be Paper Trading, what I'm currently doing. The cost for the Membership for the Stocks to Trade is roughly $2000. See they often say that the best experience is the experience. Which leads me to the decision. I MUST GET MY SKIN IN THE GAME. Yes, I understand that paper trading is great, but nothing beats the real deal. I have been preparing for WAR for the past 55 weeks. Was it worth it? I can't answer that, I must find out. I have no expectations. Honestly, I do expect to lose it, but that is why I want to OPEN a live account now. Understand that failure is inevitable. If you are afraid to fail, then you will likely never succeed. I am only 20 Fucking years of Age. Look worst case I "loose" my entire account. NO. Remember a loss is never a loss unless you learn something from that loss. I AM PAYING MY MARKET TUITION. It means nothing in the long run. Again If that happens I will simply re-fund my account the following January. Note I still will be working weekends at Black's Barbecue for additional assets. I just know that I will be missing out on all the opportunity to come over the next couple of months. NO FOMO, but I need to get in the game. The greatest risk is not trying. The goal is $2500 at E-Trade. This brings me to my next point. I am going to be primary long Biased. Since Shorting offers tons of risk for small accounts and is extremely competitive if you don't have a large account. Yes, Paper Trading I make the vast majority of my Profits, but I must have a forehand and a backhand. Be able to go long and short. Over the past years shorting has become very popular, which leads to a massive opportunity to the LONG side. I have been tracking and must act without any hesitation or reservation. I will do a recap of when I have the Brokerage account set-up and ready to go. Again I expect to open an account. If it does not happen, then it's not meant to be. Stay tuned to find out.

To my Family: I know that you are very skeptical about what this is. I hope one day you can understand. I will always remember why I got into Trading. For Financial Freedom. I have to try. I have given my life over the past year, I know that it will get harder,but that it the flight. Like any Flight you will encounter Turbulence, but the sun is always on the other side. What do I have to Loose? I am only 20 years old.

Let's Dive into the Scan!

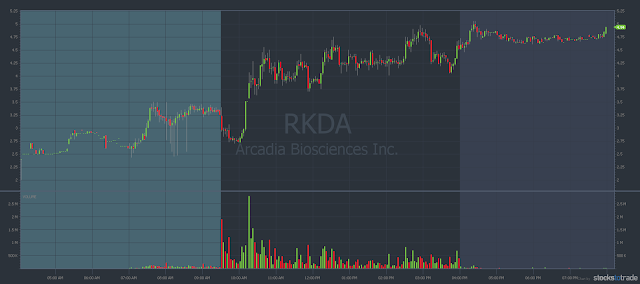

The Main watch, of course, will be $RKDA, as it was the Top percent gainer on the day. As well this is really the first Momentum name we have run in a good while. It was a massive short squeeze as I explained in the last post. Understand that short squeeze is not sustainable, but never say it can't go higher. Yes, it can. It can do whatever it wants. Taking into consideration the Low Float, this, in my opinion, will be a beauty tomorrow. So what the plan? Taking the fact that $RKDA managed to close near its highs after the late-day dip reveals an extreme sign of strength. I'm not saying this is going to go to the MOON. I am saying that we are still in the Front Side of the Move. We must wait for the Momentum Shift. $RKDA did manage to break past $5 but failed to hold those gains. Matter of fact it managed to Double top at $5. Do you see the Problem? If not I will explain it in the video recap, but allow me to explain. The fact that $RKDA managed revamp over the $4.50 level after the late-day fade is a huge Bull Flag. $RKDA managed to close at $4.94. The ODDS say this will Gap-Up. Taking into consideration the amount of Volume which was traded on the day, and the overall context. In the long run, $4.50 will act as a major Support level for a potential short. We have to see what the market gives. Pre-Market will be the tale sign, of $RKDA's potential. The higher the better.

|

| $RKDA |

|

| $AGGG |

Those are my main watches for this upcoming week. As well, of course, I am still short $DCGD, but my risk has not been hit. This is a classic dead cat bounce pattern, which is a high odd set-up. I will simply cut my loss if my level is breached. I do have more potential plays which I will discuss in the Video Recap Above. Again hope this all makes sense, if not the Video recap should Clarify what my major points. If not feel free too comment below. Have a Great Week!

Disclaimer: This blog has a terms of use that is incorporated by reference into this post; you can find all my disclaimers and disclosures there as well.

Comments

Post a Comment